For the 6th year, Client Stat is pleased to announce the findings of our analysis of institutional Learning Management System (LMS) usage in US higher education. As in the past, our methodology begins with the current list of institutions provided by the US Department of Education with more than 500 full time equivalent students and counts all LMSs in active, production use at an institution including pilot LMSs and co-production LMSs when used at a department-level scale or larger. Our QA process removes any LMS that is determined to be used by only a single professor, for a single course, or that only exists for sales or demonstration purposes.

Hundreds of universities have closed, merged, or changed ownership

The most recent list of universities recognized by the US Department of Education has shrunk from a high of 7,643 institutions in 2013 to only 6,910 this past year. For-profit institutions in particular have changed in structure dramatically over the past 1-2 years as they’ve changed ownership and consolidated. Smaller colleges are another segment affected by closures and mergers. Because of this, it has caused significant, though artificial (that is, not intentional), shifts in LMS usage across all types of LMSs. It has also resulted in a growing number of phantom LMSs that technically exist but are no longer in use.

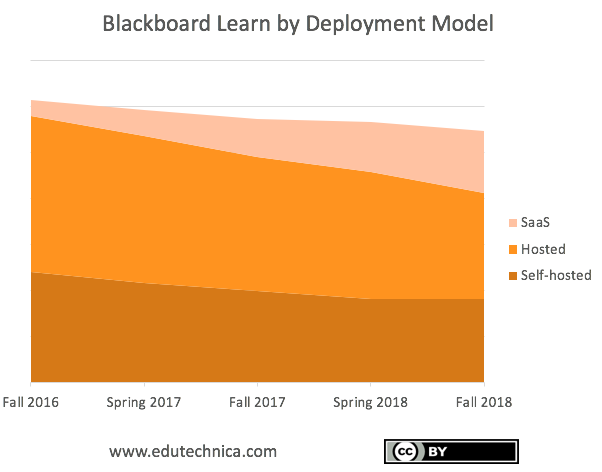

Vendor-hosted, SaaS delivery is the default LMS architecture

When implementing a new or replacement LMS, almost no school has chosen a configuration that is not hosted by the LMS provider and delivered in a SaaS manner. It is exceedingly rare that any school chooses to do otherwise.

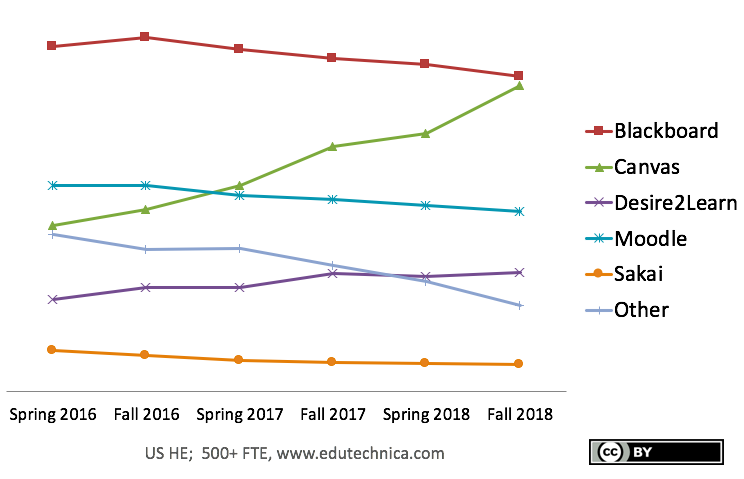

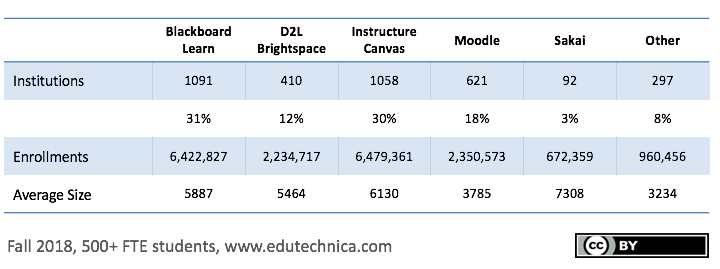

Instructure continues to narrow Blackboard’s lead

While other sources of LMS market share information assert that Instructure has passed Blackboard in terms of market share, we disagree. Especially when considering the Blackboard-owned Moodlerooms LMS (recently rebranded as Blackboard Open LMS), Blackboard still maintains a significant lead. Instructure Canvas has, however, surpassed Blackboard Learn in terms of FTE student enrollments over the past year. If Instructure maintains its current pace, Instructure Canvas will also surpass Blackboard Learn by number of institutions in early-to-mid 2019.

Blackboard is in a much healthier place

Blackboard continues to make significant progress converting Blackboard Managed-Hosted and self-hosted installations to Blackboard Learn SaaS. This reduces the complexity that the organization faces by keeping a growing number of institutions on the same, up-to-date version of Blackboard Learn. There is a narrowed spread of product versions in use, significantly fewer institutions running an unsupported product version, and based on historical leading indicators fewer institutions than ever are actively pursuing LMS migrations away from Blackboard Learn.

Moodle and Sakai continue a protracted decline

While new institutions continue to adopt Moodle, its losses continue to outpace its growth. However, remaining Moodle institutions have made significant progress over the summer upgrading their LMS environments to a supported version. Sakai also continues to experience ongoing decline with more than one-third of the Sakai installed-base actively investigating a replacement LMS (with most expected to migrate to either Blackboard Learn or Instructure Canvas during the next 2 years).

D2L continues to make significant progress moving to Amazon for hosting

In late 2016, D2L announced that it was moving to Amazon Web Services to host its Brightspace LMS infrastructure. More than half of D2L’s customers are now running in this configuration, and the organization has been tremendously successful moving forward from a legacy product architecture.

ANGEL and Pearson LearningStudio (eCollege) have been phased out

Years after the end-of-life was announced for each of these products, not a single remaining institution is using either of these LMSs in an exclusive manner to actively teach online classes (though some of these LMS environments are still running in an archive-like state).

Finally, fewer institutions are choosing “Other” LMSs

While Schoology and Jenzebar’s bundled LMS continue to see success, the market continues to consolidate largely on Blackboard Learn, D2L Brightspace, Instructure Canvas, and Moodle. Most related success in this space can be found with LMS-like products that plug into the existing dominant LMSs to provide learning paths/adaptivity and Competency-Based Education (CBE)-like capabilities.

For inquiries, please contact marketdata@clientstat.com