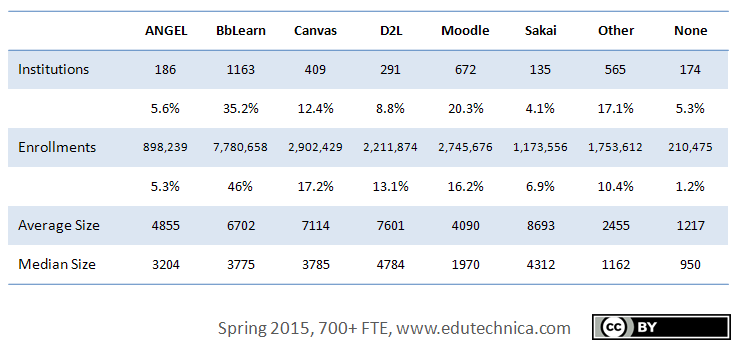

For this spring’s update (though, can we really call it spring yet?), the Edutechnica team has increased our data set to include all US higher education institutions with more than 700 students, improved our ability to detect pilot and co-production LMSs, and improved our ability to categorize “other” LMSs. This is what we’ve found:

- Uptake of the latest version of Moodle (2.8) is steady and in-line with historical trends. Blackboard upgraded its Moodlerooms Joule product to Moodle 2.7 giving this more-recent Moodle version a bump this quarter as well.

- Several D2L institutions appear to be running Brightspace version 10.4. This version has been rumored to be D2L’s continuous delivery release featuring automatic monthly updates. This is an encouraging sign of progress for the company which first announced the new model in summer of 2013.

- The share of Blackboard Learn has increased slightly, driven primarily by institutions converting from ANGEL. Almost half of Blackboard’s Learn customers are on the April or October 2014 releases at this time. The other half appears to be using a long-tail of older versions with a handful still running Blackboard Academic Suite version 8. At long last, no school appears to still be running WebCT as their only production LMS.

- Uptake of Sakai 10 is minimal, although it is (in our opinion) the most game-changing release for this LMS to-date. About one third of the Sakai client base appears to be actively pursuing an alternate LMS at this time.

- Instructure Canvas usage has soared to over 400 institutions. The company has still retained its ability to keep every one of its hosted customers in lock-step on the most recent release of Canvas.

- The top “other” LMSs are: custom, Jenzabar, ed2go, Campus Cruiser, and WebStudy. Of custom LMSs, PlumTree and SharePoint appear to be the top 2 identifiable CMS platforms on top of which LMS-like capabilities have been developed.

Blackboard is an interesting case study for this update given its most recent M&A activities. By considering unique ANGEL, Blackboard Learn, and Moodlerooms installations and then de-duplicating institutions, Blackboard’s overall LMS market share has dropped to 44.1% of institutions from an estimated 80-90% following the WebCT acquisition in 2006. Of the remaining ANGEL installations, fewer than one third are currently investigating Blackboard Learn (more than one third but less than half are exploring non-Blackboard solutions; the final third has until October 2016 to migrate to another LMS). The US higher education market for LMS products has clearly become very saturated. Blackboard must know this, as it has been taking significant actions to more rapidly build a K12 presence, first by its merging with Edline during the private equity takeover and most recently by its acquisitions of ParentLink and Schoolwires. When a market becomes saturated, dominant companies need to choose from a variety of alternative strategies to sustain growth. During the past decade, the company has employed many strategies to do so including:

- Forward integration, or gaining ownership of distributors, as evidenced by the the acquisition of NetSpot, a Blackboard Collaborate re-seller

- Backward integration, or gaining ownership of suppliers, as evidenced by the acquisitions of Xythos, the underlying CMS technology for Blackboard Learn, and Requestec, a supplier of WebRTC technology, presumably to be used for Blackboard Collaborate

- Horizontal integration, or gaining ownership of competitors, such as the acquisitions of ANGEL, WebCT, and Moodlerooms

- Market development, or introducing current products into new geographic areas, as evidenced by ramping up international expansion

- Product development, or the improvement of existing products such as the new UX in-development, or the development of new products such as xpLor

- Related diversification, or adding new but related products, such as SafeAssign plagiarism detection or the mobile campus app product that is now called Blackboard Mosaic

- Unrelated diversification, or adding new but unrelated products, such as the acquisition of NTI Group which provides a product that allows for mass text and voice notifications typically used in emergency situations. Another example of this which straddles the line of related/unrelated is the acquisition of Presidium which gave the organization a leg up in building a new student services line of business.

- Retrenchment, or regrouping through cost and asset reduction to reverse declining sales and profit, as evidenced by several recent rounds of layoffs.

It is with good reason, though, that Blackboard is actively expanding into K12 given the waning presence of its cash-cow LMS product at the university level. The K12 market is significantly bigger, representing almost 100,000 individual US schools compared to higher education’s roughly 7000, and presents greater opportunities for continued growth. The biggest challenge for Blackboard is that procurement processes and preferences for K12 schools vary widely down to the local level. And keeping many focuses within a single company could prove to be challenging to coordinate. Acquiring companies who specialize in K12 needs and who have gone through the tremendous legal, contractual, and procedural efforts required to be added to each school district’s approved vendor list is a smart move.

Anyhow, apologies for meandering down business school lane. But we believe that the data this quarter provides an artifact to a case study of how a market-leading company has needed to change and evolve over time. Here are your spring 2015 US higher education LMS stats.

This post written by the Edutechnica team and sponsored by Client Stat.

This post written by the Edutechnica team and sponsored by Client Stat.