For the 8th year, Client Stat is providing findings from our analysis of institutional Learning Management System (LMS) usage in US higher education. This update is particularly noteworthy as institutions grapple with the need to quickly pivot to online instruction as the primary means of delivery due to the ongoing pandemic. As in the past, our methodology begins with the current list of institutions provided by the US Department of Education with more than 500 full time equivalent students and counts all LMSs in active, production use at an institution at a department-level scale or larger. Our QA process removes any LMS that is determined to be used by only a single professor, for a single course, or that only exists for sales or evaluation purposes.

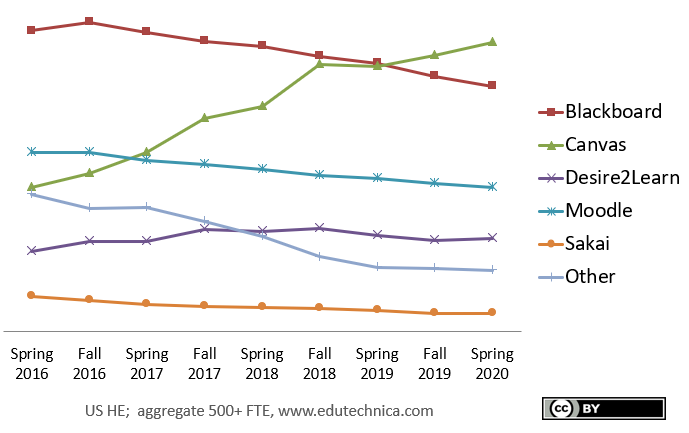

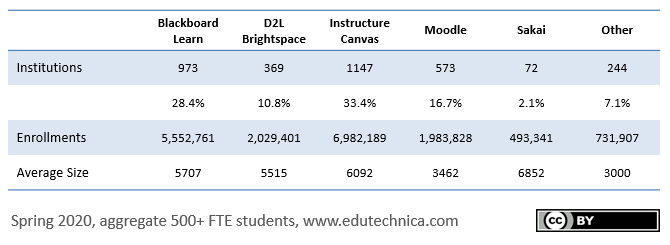

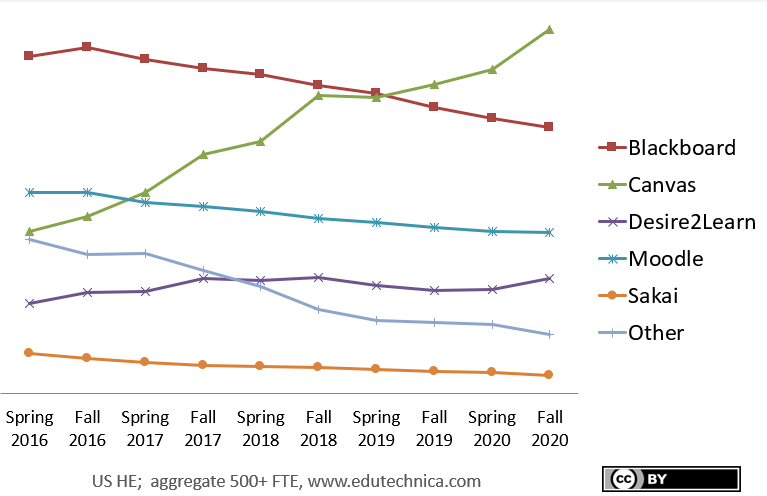

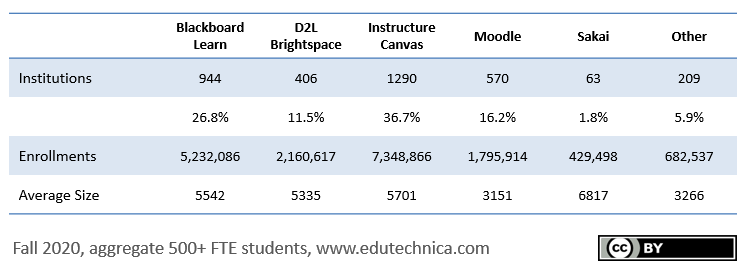

Instructure Canvas and D2L Brightspace See Positive Gains

After a period of slowing growth, Instructure is again seeing accelerating adoption of its Canvas LMS. Most schools migrating to Canvas this fall are coming from Moodle and legacy Blackboard Learn (that is, not an Ultra-capable version). D2L Brightspace also experienced an uptick in adoption this fall driven by the University of Maine System and other institutions along the east coast.

Blackboard Learn, Moodle, and Sakai Losses Continue

While Instructure and D2L saw gains this fall, Blackboard Learn continues its steady and protracted decline without slowing. Also seeing losses are Moodle – which saw a mix of additions and losses – and Sakai which also sees steady decline.

Use of “Other” LMSs has also dropped to an all-time low as institutions migrate to the more dominant LMS platforms. This may be driven by the poor usability or lack of ability to scale sometimes seen from LMSs bundled with Student Information Systems (SISs), homegrown LMSs, and other lesser players in the market during a time period when the quality and reliability of the online student experience is critical to institutional success.

LMS Migrations Aren’t Slowing

200 institutions either switched LMSs or adopted additional LMSs between spring and fall of this year, a higher-than-normal amount compared to previous years. Schools are choosing to migrate either all-at-once (immediately decommissioning the former LMS) or in a phased approach during which both LMSs remain accessible over 1-2 semesters.

There appears to be no noticeable variation in these two approaches based on size of institution. Tools and other mechanisms exist to make such migrations largely automated and turn-key with some manual validation and clean-up. Institutions would be wise to consider the impact of change management and institutional culture as two significant factors when determining an appropriate LMS migration strategy.

Some Schools Just Can’t Pivot Online

There remains a long list of schools – music and fine arts schools, vocational schools, beauty and barber schools, automotive training schools, flight schools, and commercial driving schools as examples – for which it is arguably impossible to offer an equivalent or approximate online experience. Despite the ongoing circumstances, these schools have shown little sign of offering online courses as an alternative to in-person instruction.