The COVID-19 pandemic has forced difficult decisions at every college and university. These have played out in different ways at different institutions across the US. Many institutions adapted to accommodate new online and hybrid approaches to learning. Others scaled existing practices. This was accomplished by using both synchronous online platforms (like Zoom or Microsoft Teams) and also incumbent, but largely asynchronous, Learning Management Systems (LMSs).

Trends

Some would argue that this past year was “the moment” for LMSs. Indeed, the number of institutions without a LMS fell to an all-time low. Other trends accelerated as well including efforts to switch systems or consolidate from multiple to a single LMS.

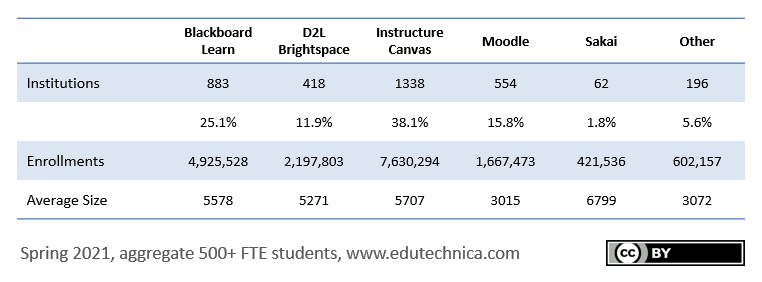

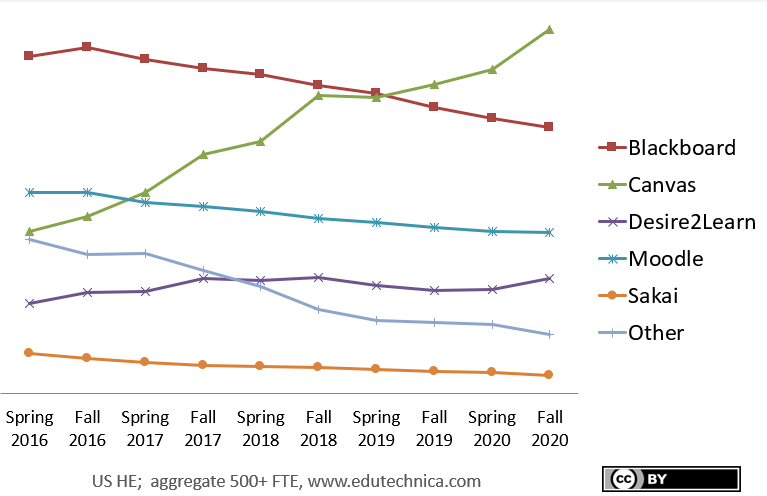

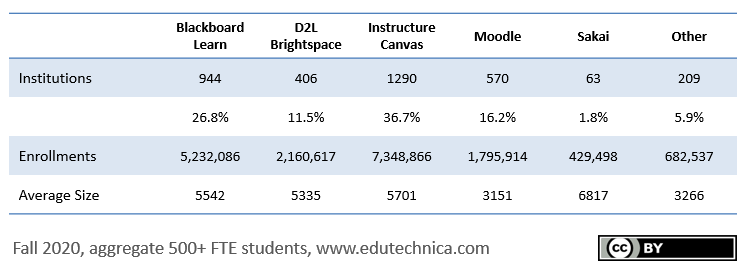

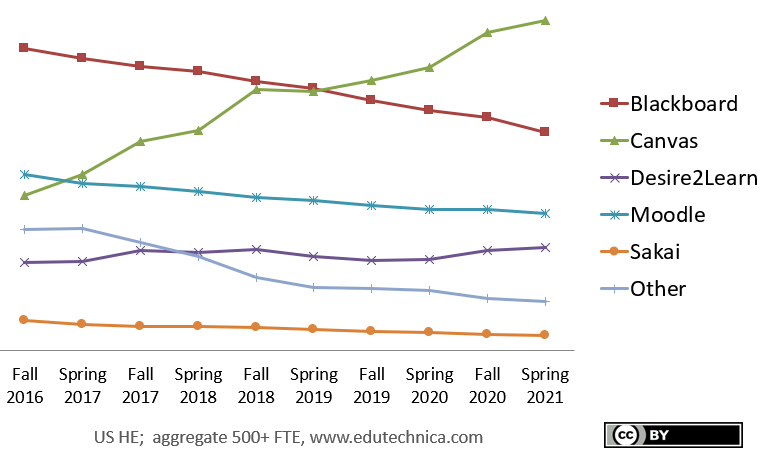

There are no surprises in our data which measures US institution-scale adoption of LMSs. Usage of Blackboard Learn continues to decline at a steady pace. Usage of Moodle and Sakai are both slowly declining. There are bright spots for D2L Brightspace which is steadily growing and for Instructure Canvas which continues to grow at a similar pace to the time period before the company was acquired by a private equity company.

By the numbers, Blackboard has significantly reduced the product version sprawl of active Blackboard Learn installations. In addition, more than half of their customers are running on their newer SaaS architecture on AWS at this time (with another smaller cohort running on Blackboard’s Managed Hosting service). This significantly improves the company’s ability to provide product support and compatibility with other related learning and back-end systems. D2L Brightspace continues to pick up new customers and university systems. Instructure continues to attract new customers to its Canvas learning platform, successfully consolidating many multi-LMS institutions onto its solution. Moodle has been both shedding and attracting new institutions but experienced an overall net loss in US higher education.