For the fifth year, we are pleased to share our annual market share analysis of LMSs used by higher education institutions in the US and in other areas around the globe. The numbers below quantify those institutions running an LMS (or LMSs) to deliver live course materials at a program, department, or institution-wide scale. Sales/demo environments, and LMSs used by a single instructor or to teach a single class, are excluded.

To briefly review our methodology, we utilize a combination of techniques to automatedly identify LMS implementations that are materially-connected to those higher education institutions officially recognized by the US and Australian Departments of Education, the Department of Employment and Social Development in Canada, and the Department for Education in the UK. We also use sources including social media, student newspapers, listservs, press releases, and other official communications to verify and validate our data. The results are then reviewed by a team of analysts familiar with the subject matter to identify and resolve any anomalies or inconsistencies.

Overview

Since Fall of 2016 we have observed some of the most massive shifts in LMS usage we’ve seen since this project began, driven primarily by factors including:

- The increasing desire for more-pleasing student and instructor user experiences that more-closely match consumer-grade software and apps

- The increasing popularity and convenience of reliable, vendor-managed LMSs

- A trend towards hosting LMSs using cloud providers for reasons that include flexible scalability, predicable cost, business continuity, and the challenge of attracting and retaining relevant technical talent on staff

- Forced upgrades and migrations such as those caused by the revised end-of-life of ANGEL (acquired by Blackboard in 2009) and the impending end-of-life of Pearson’s LearningStudio (formerly eCollege)

As universities switched LMSs over the past year, there has been a clear and increasing level of comfort and reliance on LMS vendors (and through these vendors, typically also a third-party cloud services provider such as Amazon Web Services or Rackspace) to host and maintain their learning platform infrastructure. Even when an institution chooses to manage its own LMS, it is often still hosted on third-party cloud infrastructure. Almost no new LMS implementations are self-hosted on-premises (the exception here is mainly Moodle at smaller institutions).

It is also clear that institutions are moving with more deliberate intent away from legacy LMS architectures and older LMS versions towards the compelling, modern user experiences provided by Instructure’s Canvas LMS, D2L’s Brightspace Daylight user experience, and Blackboard’s Learn SaaS LMS with the Ultra user interface. Fewer institutions than ever are running outdated LMS software – likely because of dated user interfaces, frustrating glitches and incompatibilities with modern web browsers, and the risk of security flaws in older, unmaintained software.

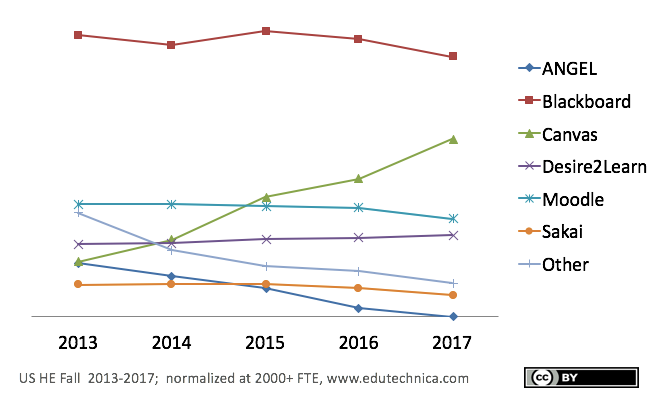

LMS changes have been most-pronounced among larger schools (having more than 2000 students) in the US. Here we see the continued, significant growth of the Instructure Canvas LMS and the gradual rise of D2L’s Brightspace LMS. Moodle, Sakai, and Blackboard have each fallen slightly-to-moderately out of favor. Institutions of this size continue to responsibly migrate away from the legacy ANGEL and Pearson LearningStudio LMSs which are, or soon will be, no longer supported by their vendors.

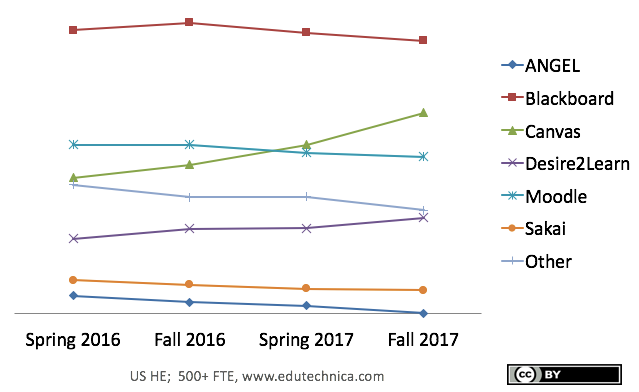

When considering schools down to the smaller size of 500 students, we see that these trends still hold. Smaller-to-medium sized universities (between 500-2000 students) exhibit more diversity in their online learning platforms. Specifically, you will see in the figure below that when compared to the one above “Other LMSs” are used by a larger proportion of institutions. Smaller institutions are more likely than larger ones to utilize less-conventional LMSs and LMS-like solutions such as Absorb, Agilix Buzz, Edmodo, Epsilen, Focus, Google Classroom, Haiku, Learner Community, NEO LMS, Notebowl, OpenClass (to be retired in January 2018), School Loop, and Schoology. Smaller institutions are also more likely to use the LMS bundled with their SIS (such as Jenzabar’s eLearning, formerly eRacer, LMS) or with other campus software (such as Campus Cruiser’s Knosys).

By the Numbers

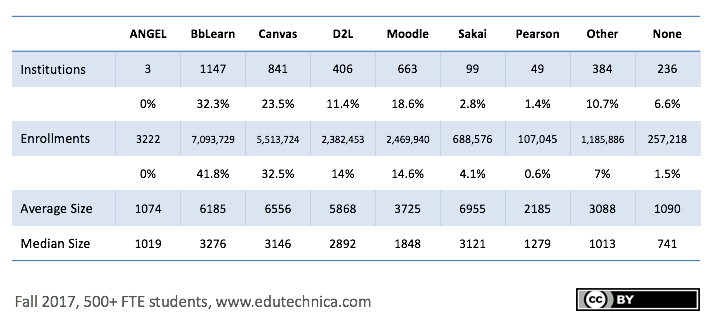

Overall, the market share among the major LMS platforms continues to become more balanced. Though its share continues to decline, Blackboard still leads the US higher education LMS market with just under one-third of institutions and just over 40 percent when measured by student enrollments. Instructure has more than doubled its market share position, both by number of institutions and enrollments, over its next nearest commercial competitor, D2L. Moodle has entered a gradual decline, picking up fewer than 20 new institutions but losing around 50 since this time last year. Sakai continues an accelerating decline losing 20 percent of its installed-based year over year and picking up no new significant institutional deployments in the US. ANGEL has gone extinct, and we expect Pearson’s LearningStudio to experience the same fate by this time next year.

Global Highlights

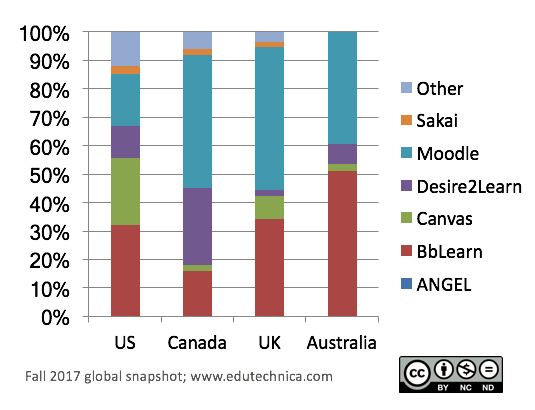

While the US LMS marketplace is largely dominated by commercial LMSs, each region of the world has a different LMS footprint. The figure below shows percentages of each LMS used as a total of all LMSs used by country. Because the US has such a disproportionately high number of universities, small changes in other geographies can shift market share numbers significantly.

Overall, the LMSs used in these non-US regions have been stable recently, largely because they have been isolated from the churn caused by the discontinuance of legacy commercial LMSs that were rarely or never licensed outside of the US (e.g.: CourseInfo, Prometheus, ANGEL, eCollege/LearningStudio) coupled with a lack of viable local competition. The last major period of LMS churn outside of the US followed Blackboard’s acquisition of the Canadian LMS company, WebCT. With the incumbent LMS vendors being largely stable, we do not expect massive shifts in these regions in the near-term.

Highlights

ANGEL

Almost all institutions have successfully and responsibly chosen replacement LMSs for this solution which reached its end-of-life last October.

Blackboard Learn

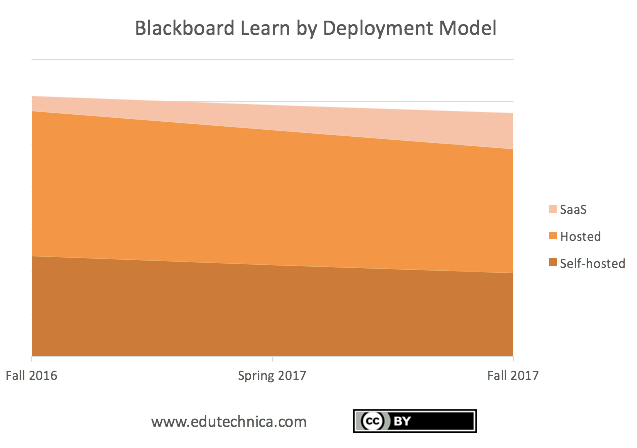

Blackboard continues to push forward with improvements to its many deployment models. Since we started tracking deployments of Learn SaaS last Fall, Blackboard has slowly and steadily been adding to or converting its client base to this new model while reducing the number of self-hosted institutions. This should help the organization to gradually overcome the challenges posed by the many technology and version combinations that it currently supports.

D2L Brightspace

D2L Brightspace experienced a bump in growth this year driven mainly by conversions from Pearson LearningStudio and continues to experience healthy, gradual growth. The organization has also had much success with its continuous delivery deployment model which keeps the majority of its customer base on a consistent, supportable version. Brightspace also continues to be the most popular commercial LMS among higher education institutions in Canada, where its parent company is headquartered.

Instructure Canvas

Instructure Canvas continues to experience consistent, rapid uptake by institutions migrating away from all other major LMSs and even by some schools that previously did not have a LMS. Last year, Canvas proved capable of breaking into each of the global regions that we track. This year, it continues to expand its presence, most notably in the UK.

Moodle

Despite recent improvements, particularly in the area of user experience, Moodle does not seem to have gained any significant, new traction. A portion of the decrease in the number of Moodle institutions was caused by smaller institutions that have either merged or ceased operations. Moodle continues to have a much larger footprint, by percentage of total institutions, outside of the US.

Pearson

Pearson has chosen to exit the LMS market by discontinuing its LearningStudio and OpenClass LMS products effective at the beginning of 2018. A much larger proportion of Pearson’s LMS customers were large, multi-campus, for-profit institutions that have ceased, or decreased the footprint of, their operations. (Most of these institutions were accredited by ACICS which has also undergone significant challenges recently).

Sakai

Sakai is experiencing consistent yearly declines in every region that we are tracking globally. These declines come despite recent functional and technical improvements. At least some migrations away from Sakai appear to have been driven by the reported ongoing challenges and uncertainty in the Sakai vendor/partner community.

Other

No single “Other” LMS has yet experienced the significant traction that Instructure began to have with Canvas in 2012/2013 though there are several mentioned above that have smaller footholds. The only micro-trends that we have begun to detect are (1) a greater exploration of LMSs that operate more like learning communities than content delivery systems and (2) early signs that medical and business schools in particular, after a period of LMS consolidation, are again starting to explore LMSs that are separate from the core institutional LMS for specific pedagogical or marketing/branding reasons.

For press inquiries, please contact marketdata@clientstat.com