In this day and age, sensational headlines grab attention and can spread disinformation like wildfire. A recent post from MindWires Consulting makes the very significant claim that Canvas has finally surpassed Blackboard in market share. It has been referenced far and wide, even appearing in a Bloomberg article (note: our data did, too). In addition to this claim, there are some other great points made about Blackboard’s current financial status under its private equity ownership, but the longer-term health of the company may actually be better than what this analysis may lead you to believe.

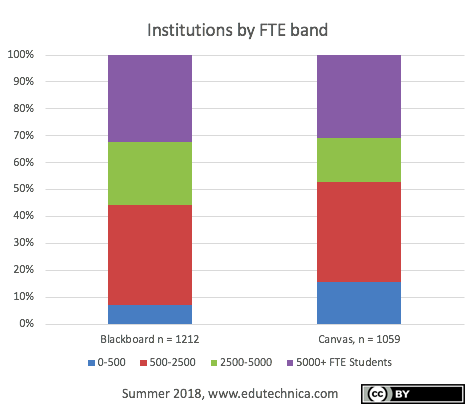

While our team usually only focuses on 100% coverage of those 3590 US institutions with more than 500 students (what the customers of our data generally consider to be their addressable market), over the past 2 days our team of data scientists has been working to collect LMS usage data on the complete set of 7643 US colleges and universities. Our preliminary findings show a statistically significant difference in the number of Canvas installations compared to that referenced in the MindWires post: Canvas at 1059 institutions to Blackboard’s 1212. We also differ significantly on student enrollments by vendor. By our analysis, taken directly from US Department of Education data, we have Canvas at 5,783,554 students compared to Blackboard’s 6,936,895 – a difference of more than a million. This is in-line with Blackboard’s comments made in this recent Inside Higher Ed article.

Phill Miller, chief learning and innovation officer at Blackboard, said that the data shared by Feldstein were “not consistent with our own,” which show that “Blackboard remains the dominant ed-tech company around the globe.”

Note that our methodology only considers actual running LMSs – eliminating sales and demo sites but including verified pilot LMSs when used to teach students live courses. It does not include any LMS changes that have been announced but that have not yet occurred. More often than you’d think, these deals fall through or take so long to materialize that they can be reversed. Larger deals that involve multiple universities or entire university systems take even longer, and in some cases the drive towards standardization is resisted or results in an ongoing multi-LMS environment. University systems and multi-campus institutions pose the biggest challenge to the analysis of LMS market share. We consider schools at their most granular level. If the US Department of Education has issued a unique identifier for the college or campus, we count it as its own entity. Fortunately, the data provided by IPEDS also allows easy correlation of institutions based on a parent entity identifier.

What we found is that 144 Canvas installations belong to just 10 schools. Search the College Navigator for “Remington” or “Carrington” or “DeVry,” and you will understand why. These are large, multi-state, for-profit institutions that license Canvas and for which the Department of Education counts each individual local “campus” separately as its own institution. This artificially inflates the number of Canvas installations, especially among the smallest institutions having fewer than 500 students. (It also does the same for Blackboard installations, but to a different extent because of the difference in makeup of its customer base. Blackboard has a larger proportion of larger institutions than Canvas.) If you are going to pose that one company is healthier than another based on this sound bite alone when your job is to provide advice to leaders of higher education institutions, you have to account for this nuance.

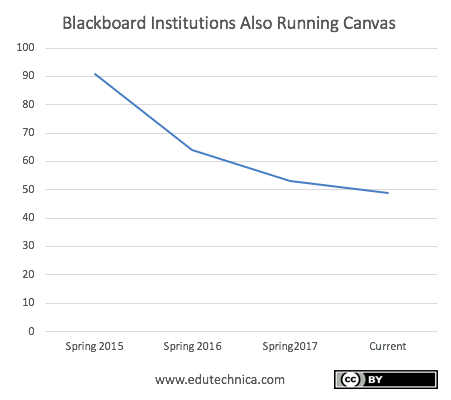

Here’s another. According to our data, as of today, just under 50 Blackboard universities are also running Canvas. This condition usually indicates a LMS pilot or active migration (although in some rare cases, a university will support both LMSs). Not all institutions that pilot Canvas end up switching, and the number of Blackboard institutions also running Canvas is actually in decline. This suggests that fewer universities are considering switching away from Blackboard to Canvas and also that the rate at which they are is declining.

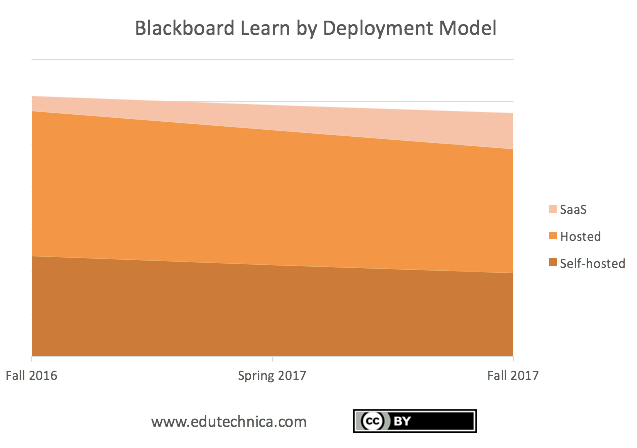

As mentioned in our post last fall, Blackboard is also making significant progress towards migrating its customer base onto its SaaS and hosted versions.

This trend reduces complexity and improves the consistency of the installations that Blackboard has to support. Canvas has the lead on Blackboard here because they only support one version (the live version that everyone is running) and only need to hire for the skill set required to support their one technology stack (Blackboard, in contrast, still needs to support self-hosted server installations on Windows). D2L was previously in a very similar situation prior to moving its Brightspace customers onto its continuous delivery model, which they succeeded with quickly and admirably. Blackboard is making progress here, too.

In full disclosure, the author of this article used to work for Blackboard and held frustrations with the company “being run” by Sales or Legal or Finance depending on the leadership era considered. The thing that gives me the most hope (that is, besides all of the evidence above) is its current CEO, Bill Ballhaus. I’ve never met him, but I am encouraged that his background is as an engineer. Someone with his background would understand the reality that it takes time to systematically dig an organization in Blackboard’s situation out of significant and complex technical debt.

I also admire and give much credit to Instructure for their amazing progress, but I suspect that even they know that their growth in higher education will eventually slow, and Instructure doesn’t have the breadth of products and services that Blackboard has to make up for the difference. The transcript of Instructure’s most recent investor call barely mentions higher education at all and instead focuses almost exclusively on the growth of their corporate learning products. Led by their investors’ interest, this is where I suspect that Instructure’s focus will soon be redirected.

The biggest change I see in the LMS marketplace is not a “new world order” where Canvas dominates but instead the establishment of a healthier balance among the major players and a renewed focus on competing through improved product experiences and service differentiation. All LMSs seem to be making great strides in these regards.

Blackboard unfortunately has some serious finances to work out, but the organization is far from down and out.

This is a guest post authored by George Kroner. For media inquiries please contact marketdata@clientstat.com