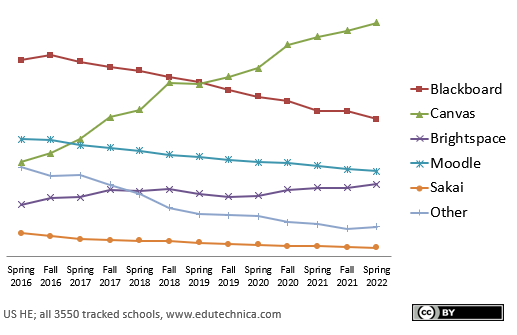

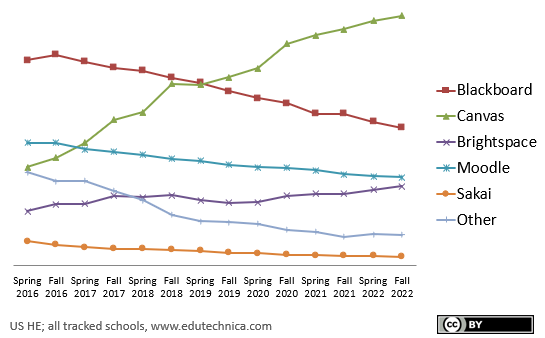

As we look back at 10 years of tracking LMS (Learning Management System) usage in the US, we are still impressed by the continued dynamic nature of this space – the trends, the churn, the expected and unexpected. Over this time period Blackboard Learn – once dominating almost the entire industry – has lost a third of its customers. Instructure Canvas has tripled in size during the same time – going public, being taken private, and then going public again with leadership transitions to match. Moodle’s popularity has faded with significant drama related to previous corporate partnerships. Sakai lingers. D2L Brightspace went public in Canada and is soon poised to overtake Moodle as the #3 LMS in the US (it already has by student enrollments). Almost no schools build their own LMS – and if one does, it’s built on top of another platform not their own code-base. More state and regional systems are standardizing on a single brand of LMS with fewer schools than ever running multiple LMSs.

Most LMSs are now hosted by vendors or are otherwise in the cloud, almost exclusively on Amazon Web Services. This is a notable achievement in an industry that tends to move slowly. This is true for schools both large and small. Because of this, schools are consistently running recent product versions with very few drifting gradually into unsupported status, historically a condition prompting a LMS migration.

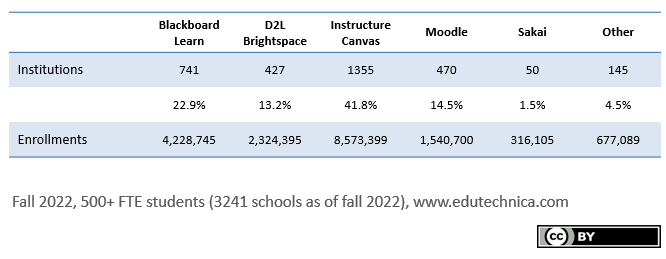

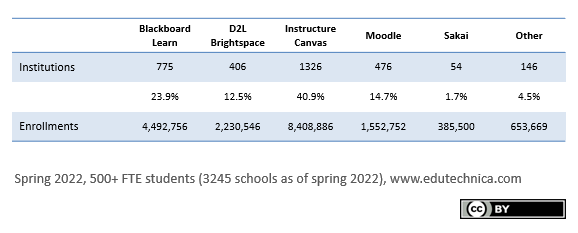

The trends from spring to fall of 2022 remain consistent. Instructure Canvas continues to grow its commanding lead. Blackboard Learn continues to shrink in-line with historical pace. D2L Brightspace steadily grows. More Blackboard customers are choosing to use the Ultra LMS version, but net-new implementations due to LMS migration are still won predominantly by Instructure Canvas or D2L Brightspace.

When looking at total addressable market (defined by us as institutions with 500 or more students, removing schools that have closed or merged since spring 2022), Instructure Canvas has almost double the implementations of its nearest competitor and more than double the number of students using its platform. In our opinion, the development to watch is the slow, steady, and continuing growth by D2L Brightspace.